TIN (Taxpayer Identification Number) is a unique set of numbers assigned to each registered taxpayer in the Philippines. Every time you transact with the Bureau of Internal Revenue (BIR), it’s a fundamental requirement, hence the need to apply for it as soon as you enter the workforce. This guide will teach you how to get TIN number, including the latest requirements, application process, and fees.

Disclaimer: This article is for general information only and is not substitute for professional advice.Go back to the main article: Tax in the Philippines: An Ultimate Guide to Filing and Paying Taxes

A Taxpayer Identification Number (TIN) is a unique system-generated number that the Bureau of Internal Revenue (BIR) assigns to every person registered in its database. Since it’s a permanent number, you’re supposed to have only one TIN in your lifetime. If you already have a TIN, you should not get a new one even if you change jobs or shift from being employed to being self-employed.

The TIN gives the BIR a quick way to access, track, and process a taxpayer’s information and transactions with the national tax collection agency. It works like a bank account number that allows the bank to identify the right account to debit or credit a financial transaction. The same goes for the TIN—it’s what the BIR uses to record correctly a tax return filed by a taxpayer.

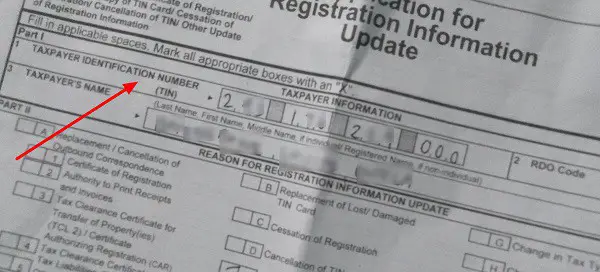

The TIN consists of nine to 12 digits, with the first nine being the TIN proper and the last three being the branch code (for corporate taxpayers). For individual taxpayers, the default value is 000 for the last three digits of their TIN. The first digit of the TIN identifies the taxpayer type. TINs that start with 1 to 9 belong to individual taxpayers. If a TIN begins with zero (0), it’s owned by a corporation. The first three digits of a TIN indicate when the TIN was issued. For example, TINs that start with the 000 series (for corporations) and 900 series (for individuals) were issued before the Integrated Tax System (ITS) implementation in 1998. Meanwhile, the BIR issued TINs that begin with the 200 and 400 series under the ITS. Taxpayers who registered online are issued TINs starting with the 300 series.

All Filipino and foreign citizens required by law to pay taxes in the Philippines must first register with the BIR to secure a TIN. But before applying for a TIN, you must know the correct type of taxpayer you should register for. Taxpayers are generally classified into two groups: individual and non-individual/corporate. Below are the types of taxpayers under each classification.

In BIR tax forms, local employees are called “Individuals Earning Purely Compensation Income.” The term refers to Filipinos who earn income solely through a salary from an employer based in the Philippines. Fresh graduates who need to get a TIN as a pre-employment requirement also belong to this taxpayer type.

As the term implies, mixed-income earners earn income simultaneously from business, profession, or employment.

BIR defines these taxpayers as any two or all of the following: local employees, single proprietors, and professionals.

For example, you’re a mixed-income individual if you’re currently working full-time for an employer while having a sideline.

Here’s another example from the BIR: a teacher employed in a school who works as a part-time tutor and runs a retail business. In such an instance, BIR requires mixed-income earners to register as local employees, professionals, and single proprietors simultaneously.

All foreign nationals who intend to work or start a business in the Philippines must register with the BIR, get a TIN, and pay and file taxes.

For taxation purposes, alien or foreign taxpayers in the Philippines are classified into two groups:

You should secure a TIN and register as a one-time taxpayer if you’ve never been issued a TIN before and you have to pay any of these taxes under One-Time Transactions (ONETT):

Minors, students, housewives, retirees, and other unemployed people, as well as OFWs, still need to apply for a TIN, even if they’re exempted from paying the income tax.

Under Executive Order (EO) 98, all government agencies and local government units (LGUs) must include the TIN in all forms, licenses, permits, clearances, and other official documents.

A TIN enables non-taxpayers in the Philippines to transact with government offices (such as the NBI and LTO), banks, stock brokerage firms, and other entities requiring a TIN.

For estate tax payment purposes, the BIR requires and issues a TIN for the estate of a deceased person or a trust under an irrevocable trust agreement. The TIN for an estate or trust differs from the deceased person’s or trustee’s TIN.

In legal terms, an estate comprises real properties, cash, investments, and insurance that comprise a person’s net worth. These assets are taxed upon the owner’s death before being transferred to the name of the deceased’s legal heirs.

Meanwhile, a trust is a legal arrangement in which a trustor gives a trustee the right to hold his/her assets for a third party, such as a beneficiary.

The BIR requires the following types of entities to register as corporate taxpayers and obtain a business TIN:

The TIN is not just for BIR transactions like tax filing and payment. As proof of being a taxpayer, your TIN is required when transacting with different government offices, banks, and private offices.

Here are some transactions or instances when you’re required to provide your TIN:

Taxpayers can secure a TIN through walk-in registration at their assigned revenue district office (RDO) or online registration via the BIR eRegistration website.

Processing the TIN of walk-in applicants takes around 30 minutes to an hour. But it could take much longer, depending on the volume of people transacting during the day.

The online registration process is much shorter, at less than 5 minutes. However, the BIR’s online service is available only to registered employers securing TINs for their employees. Most taxpayer types have to register manually using appropriate BIR tax forms.

The BIR Form 1901 is filed by self-employed individuals, whether single proprietors or professionals, to register with BIR as taxpayers and obtain their TIN 1 .

The same form is used for BIR registration by mixed-income individuals or employees running a business on the side, those who want to register their estates and trusts, and non-resident aliens engaged in trade/business.

The BIR Form 1902 is the tax form used to register new employees (Filipino or foreigner) who will earn purely from their salary/compensation income in the Philippines.

Most employers take care of their employees’ BIR registration. If this is the case, all you need to do is to fill out the form and submit the required documents. Once registered, you’ll be issued your permanent TIN.

If you’re a corporate taxpayer, you can register with BIR and get your TIN using the BIR Form 1903. This tax form caters to corporations, partnerships, non-profit organizations, cooperatives, associations, national government agencies, GOCCs, and LGUs.

The BIR Form 1904 is designed for those who don’t fall under the regular groups of taxpayers discussed previously. These include one-time taxpayers who were not issued a TIN previously but needed one to pay donor’s tax, estate tax, capital gains tax, and other types of one-time taxes.

This tax form is also used to register applicants not paying income taxes but under E.O. 98, like unemployed Filipinos, OFWs, etc. These applicants want to get their TIN to transact with any government office.

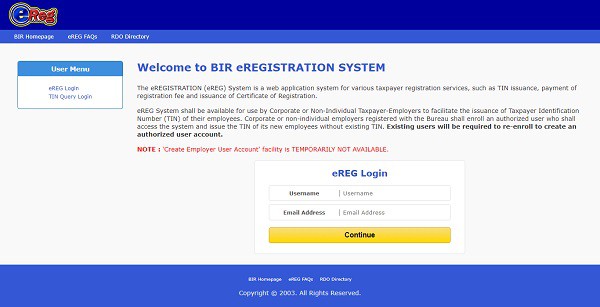

Currently, only employers or corporate taxpayers registered with the BIR can use the BIR’s eRegistration (eReg) system to secure the TINs of their new employees (without existing TIN).

In the past, the online registration service was also accessible to other taxpayer types, such as self-employed and applicants under EO 98. The BIR might restore that functionality in the future. But for now, BIR registration for these people has to be done manually at their assigned RDO.

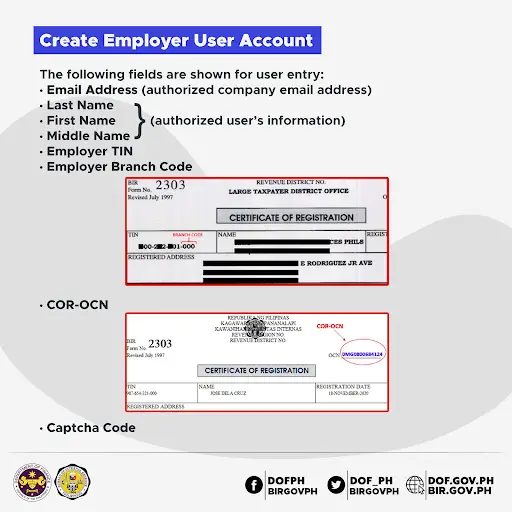

Again, employers can issue TIN for their employees through the BIR eReg system. However, they must create an account in the online system first.

Here are the steps to create a BIR eReg system account 2 :

After setting up their BIR eReg accounts, employers can now log in to issue their employees’ Taxpayer Identification Numbers (TINs). Here’s how 3 :

Yes, you read that right—you can secure a Tax Identification Number (TIN) even if you’re not employed.

Doing so shouldn’t be a problem, as long as you have no existing TIN, have a valid purpose, and submit all the requirements.

Students, stay-at-home parents, and anyone unemployed in the Philippines can apply for this number under Executive Order (EO) 98. Before you file your TIN application with the BIR, it’s essential to understand EO 98 and its role in your right to be issued a TIN.

EO 98 4 is a directive signed by then-President Joseph Estrada that requires all government agencies and Government-Owned and Controlled Corporations (GOCC) to use the TIN in all forms, permits, licenses, and other documents they issue to people transacting with their office.

This EO makes it compulsory for everyone—employed or not—to get a TIN for transactions with government offices and private institutions, such as the following:

As such, having a TIN enables you to get a valid ID, open a bank account for saving or investing, get a scholarship, and more.

Step ahead of your TIN application by ensuring you’ve gathered all the necessary documents.

The BIR may require additional documents depending on your TIN registration purpose. For example, if you need a TIN to open a bank account, you’ll be asked to submit a bank certificate (indicating “for TIN application only”).

It gets tricky because not all banks issue a certification for TIN registration. So if you’re enrolling a new account with a certain bank, ask immediately if they can give you a bank certificate for the TIN application. Otherwise, try looking for other banks that do.

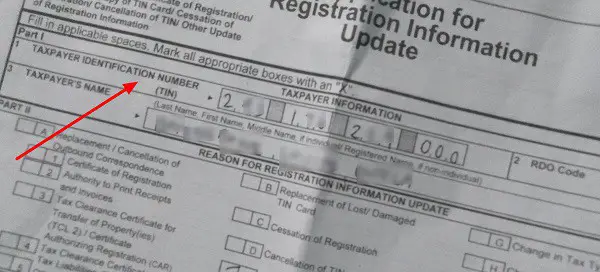

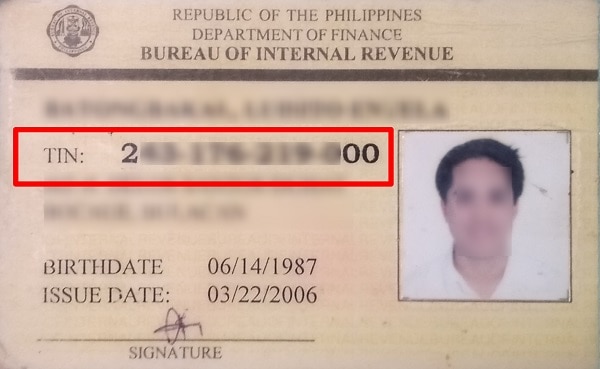

Here are pointers to guide you through accomplishing the TIN application form correctly.

Bring all the TIN application requirements to the RDO of your city or municipality.

Tell the BIR officer that you’re applying for TIN under EO 98. Also, explain why you need a TIN. You’ll be allowed to proceed with your TIN application only if your purpose is valid (i.e., a transaction with any government office or a bank).

When you apply for TIN at the BIR RDO, these three scenarios could happen. Here’s what you can do should you encounter one:

However, if you’re applying for TIN as part of the pre-employment requirements for your new job, you should be filing the BIR Form 1902 instead.

After submitting the requirements, the BIR personnel will process your TIN application.

Once your TIN is generated, you’ll be issued your copy of the BIR Form 1904 with a “Received” stamp. Keep your receiving copy, which now has your Tax Identification Number written.

The BIR officer will tell you when you can return to the RDO to claim your TIN ID.

Have you ever been issued a TIN? No need to get a new TIN, even if you’re changing a job, starting a business as a single proprietor, or transitioning from employment to full-time freelancing. You can only update your registration information like your RDO in these cases.

Just don’t get a new TIN if you already got one. Multiple TINs are a criminal offense in the Philippines, with a penalty of PHP 1,000 per additional TIN obtained.

According to the Bureau of Internal Revenue (BIR), if a taxpayer cancels his registration due to the closure of his/her business, the taxpayer will be investigated by the BIR office concerned to know the taxpayer’s liabilities.

Last Updated May 6, 2023 12:08 PM

Miguel Dar is a CPA and an experienced tax adviser specializing in tax audits. He gives tax advice to different start-ups and clarifies tax concerns of individual taxpayers. This includes helping clients register their businesses, training in tax and bookkeeping for start-up businesses, settling open cases, tax planning for future tax compliance, and responding to tax-related inquiries.

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net