All You Need to Know about SBI Student Loan Scheme

Higher education is getting expensive every day. For many families, such education must be financed through an education loan. All the banks and NBFCs provide education loans . In this post, I will discuss a popular education loan scheme from the State Bank of India: SBI Student Loan Scheme .

SBI Student Loan: Important Things to Know

- Eligibility: Available to Indian nationals for pursuing higher education in India or abroad

- You must already have secured admission to the university/institution.

- Maximum Loan Amount : Rs 10 lacs (for education in India), Rs 20 lacs (for education abroad)

- No processing fees or any upfront charges

- Repayment starts a year after completion of course. Repayment Tenure of up to 15 years.

By the way, SBI has two more loan products. I am listing down a few differences from the SBI Student Loan scheme.

- SBI Scholar Loan (available to students of Premier Institutes e.g. IITs, IIMs, NITs etc): Maximum loan amount is higher. Interest rate is lower. Lesser security is required. You can expect loan sanction process to be much simpler.

- SBI Global Ed-Vantage Loan (only for education abroad): Maximum loan amount up to Rs 1.5 crores. Broader range of expenses covered under the loan product.

In this post, let’s limit our focus to SBI Student Loan Scheme.

What Are the Courses Covered under SBI Student Loan Scheme?

For Studies in India

- Graduation, Post-graduation including regular technical and professional Degree/Diploma courses conducted by colleges/universities approved by UGC/ AICTE/IMC/Govt. etc

- Regular Degree/ Diploma Courses conducted by autonomous institutions like IIT, IIM etc

- Teacher training/ Nursing courses approved by Central government or State Government

- Regular Degree/Diploma Courses like Aeronautical, pilot training, shipping etc. approved by Director General of Civil Aviation/Shipping/concerned regulatory authority

As I see, this broadly covers the choice of courses that you would want an education loan for. However, there can always be an element of subjectivity. For better clarity, you must contact your nearest SBI branch.

For Studies abroad

- Job oriented professional/ technical Graduation Degree courses/ Post Graduation Degree and Diploma courses like MCA, MBA, MS, etc offered by reputed universities

- Courses conducted by CIMA (Chartered Institute of Management Accountants) – London, CPA (Certified Public Accountant) in USA etc

What Are the Expenses Covered under the Student Loan Scheme?

I am copying these details from SBI website.

- Fees payable to college/school/hostel

- Examination/Library/Laboratory fees

- Purchase of Books/Equipment/Instruments/Uniforms, Purchase of computers – essential for completion of the course (maximum 20% of the total tuition fees payable for completion of the course)

- Caution Deposit/Building Fund/Refundable Deposit (maximum 10% of tuition fees for the entire course)

- Travel Expenses/Passage money for studies abroad

- Cost of a two-wheeler up to Rs 50,000

- Any other expenses required to complete the course like study tours, project work etc

Do I Need to Furnish Any Security?

Depends on the loan amount.

- For loans up to Rs 7.5 lacs, there is no need to provide collateral or third-party guarantee. Only your parent/guardian needs to sign up as co-borrower.

- For loan above Rs 7.5 lacs, you need to provide tangible security. This is, of course, in addition to parent/guardian signing up as co-borrower.

If you are married, your spouse or parent(s)-in-law can sign up as co-borrower.

How Much Loan Can I Get?

These parts are never very clear to me. In addition to cap on the maximum loan amount, there is provision on margin too. Margin is the portion of education cost that you need to fund from own pocket.

- For cost of education up to Rs 4 lacs: No margin is required

- For cost of education above Rs 4 lacs: 5% for courses in India, 15% for courses abroad

In How Many Years, Do I Need to Repay the Loan?

Repayment starts one year after completion of the course. You have an option to repay the loan in up to 15 years. Typically, the loan duration is 7-8 years. Longer duration means lower EMI . Do note tax benefit is available for only 8 years. If you avail a second loan later for another course, you have to repay the combined loan amount in 15 years after the completion of the second course.

Tax Benefits on Repayment of Education Loan

Moratorium during the Study Period

There is one aspect that makes an education loan product very different from a regular loan product. It is moratorium on loan repayment during the study period. And it is needed too. How will a student repay the loan? As mentioned above, the loan repayment begins one year after the completion of the course. Interest during the study period (and the subsequent 1 year) gets accrued and is added to the loan amount. When you are ready to repay the loan, your EMI is calculated on the sum of principal and accrued interest. By the way, there is no compulsion to avail the moratorium period. You can choose to pay the interest amount during the study period too.

Point to Note: You can avail tax benefit for interest payment only for 8 financial years (including the financial year in which you start repaying the loan). So, if you plan to pay the interest during the study period, keep this aspect in mind. Personally, I believe tax consideration will only skew your decision-making. Start repaying the loan as early as possible.

What Are the Documents Required for Availing the Loan?

- Admission letter

- Statement of cost of study

- KYC documents of the student and parent/guardian

- Bank account statements, IT returns, statement of asset and liabilities for parent/guardian/co-borrower

Reach out to the bank for the exhaustive list of documents.

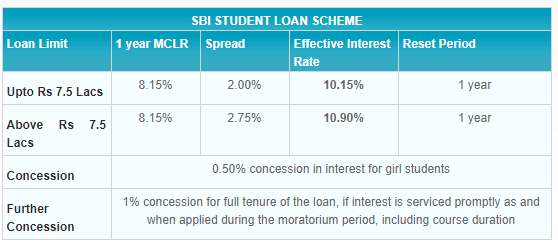

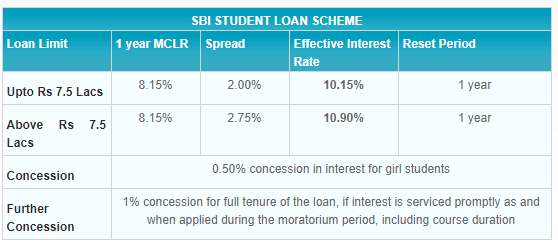

What Are the Interest Rates for SBI Student Loan?

Related

About the Author

Deepesh Raghaw is a SEBI registered Investment Adviser and a management graduate from IIM-Lucknow. He writes for leading business publications regularly, runs a personal finance blog and a financial planning firm at www.PersonalFinancePlan.in. He can be reached at deepesh.raghaw[AT]gmail.com.

Related Posts

- Feb 20, 2016 SBI FlexiPay Home Loan Scheme

- Nov 25, 2016 All you need to know about New Pension Scheme (NPS)

- Aug 31, 2017 PNB Gen-Next Housing Finance Scheme

- Apr 09, 2017 Credit Linked Subsidy Scheme for First Time Home Buyers

- Dec 20, 2017 PNB Housing Unnati Home Loan Scheme

80E education loan expenses margin Moratorium repayment sbi tax benefit

Leave a Reply Cancel reply

Calculators & Widgets

- EMI Calculator

- Android App

- Loan Calculator — Calculate EMI, Affordability, Tenure & Interest Rate

- Home Loan EMI Calculator with Prepayments, Taxes & Insurance

- Mobile-friendly EMI Calculator Widget

- Home Loan Interest Rates — As of August 31, 2024

Recent Articles

- A Home Loan Is NOT a Scam

- How Will Your Capital Gains from Property Sale Be Taxed after Budget 2024?

- How the Reserve Bank Has Hit Back at P2P Lending?

- Use Your Top-up Home Loan Wisely

- Reducing Minimum Amount Due on Credit Cards Is a Bad Idea

- What Can You Do to Reduce the Cost of Your New Car?

- Should You Finance Your Car with a Top-up Loan?

- Union Budget 2024 Highlights

Calculators & Widgets

- EMI Calculator

- Android App

- Loan Calculator — Calculate EMI, Affordability, Tenure & Interest Rate

- Home Loan EMI Calculator with Prepayments, Taxes & Insurance

- Mobile-friendly EMI Calculator Widget

- Home Loan Interest Rates — As of August 31, 2024

Android App

About Us

- Privacy Policy

- Terms of Use

- Contact Us

Copyright © 2011-2019 emicalculator.net. All Rights Reserved.